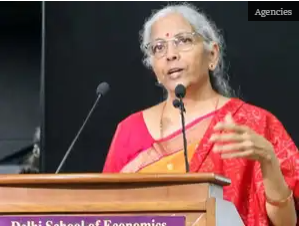

India’s Finance Minister Nirmala Sitharaman confirmed that the government has initiated discussions with the Reserve Bank of India (RBI) and various banks regarding consolidation in the banking sector. She emphasised that before any firm decisions on merging banks are taken, a more enabling environment will need to be created to allow banks to grow.

Sitharaman noted that considerable preparatory work has already begun, though no decision has yet been taken by the government. The market buzz around the consolidation of public-sector banks (PSUs) has picked up in recent weeks, she added.

The minister also highlighted the importance of banks remaining customer-centric in their operations. She stressed that local language capability and face-to-face personal contact remain a hallmark of Indian banking and must not be lost amid technological advances. She pointed out that in some public-sector bank branches staff posted across regions may not speak the local language, which hampers connection with customers.

Sitharaman further criticised overly complex documentation and cumbersome processes placed on borrowers, saying that banks must simplify their procedures rather than off-loading the burden on customers.

On the role of artificial intelligence (AI) in banking, the minister offered a cautionary note. While

acknowledging that AI tools can raise productivity, efficiency and scalability, she warned of the ethical risks and national-security vulnerabilities that can arise from misuse of such technology. She underscored the need to encourage innovation while being nimble enough to address those potential risks.

Finally, when asked about heightened retail participation in futures and options markets, Sitharaman stated that the government’s remit is limited to creating awareness of risks: “People are free to invest their money where and how they want,” she said.

The push for bank consolidation comes in the backdrop of a large cross-border deal: a UAE-based bank announced it could take up to a 60 % stake in private-sector lender RBL Bank, adding impetus to broader discussions around scale, capital, governance and growth in India’s banking ecosystem.

Leave A Comment