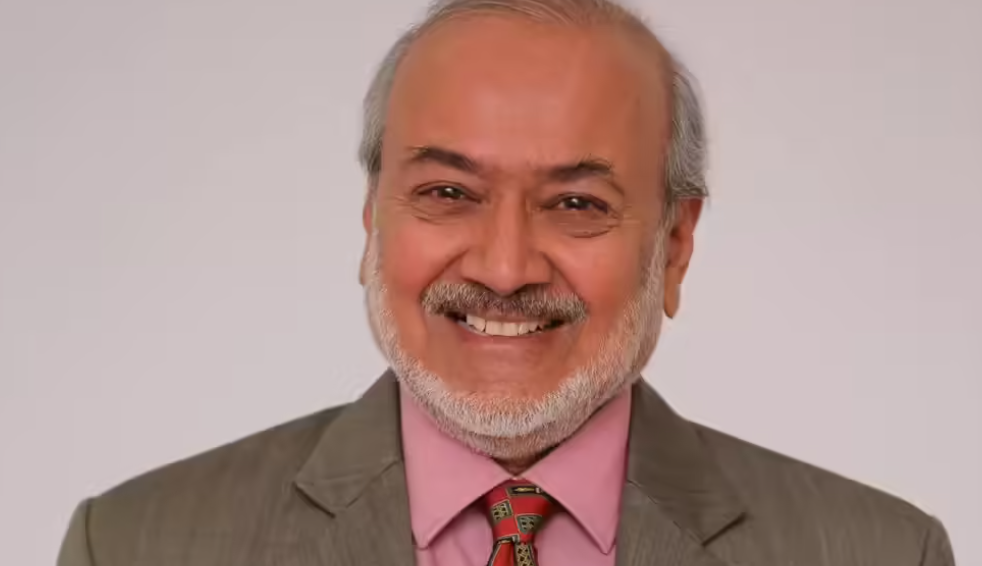

Wockhardt Ltd, once on the brink of collapse with heavy debt and troubled operations, has staged a remarkable turnaround under the leadership of Habil Khorakiwala, its founder and chairman, transforming from a debt-burdened pharmaceutical firm into a company with renewed strategic direction and potential global impact.

In the past, Wockhardt faced severe financial stress, including defaults and factory troubles that pushed it close to bankruptcy. During these challenging years, the company grappled with debt and operational setbacks that tested its resilience and financial health.

The turnaround began with a bold strategic pivot toward drug discovery and innovation. Wockhardt shifted away from low-margin segments and refocused its resources on developing novel pharmaceutical products, particularly in areas with high unmet medical need. Of particular significance is Zaynich (WCK 5222) — a next-generation antibiotic designed to combat resistant infections. This drug is considered a breakthrough and has drawn global attention for its potential to address the pressing issue of antibiotic resistance.

To sharpen focus and improve efficiency, Wockhardt also exited its loss-making US generics business, freeing up capital and organisational bandwidth for its innovation-led strategy. This move underscored the company’s shift from traditional generics to high-value biologics and new chemical entities.

Under Khorakiwala’s renewed vision, Wockhardt not only stabilised its operations but also rekindled investor confidence. The company’s stock has reflected this renewed optimism, with significant gains tied to progress in its R&D pipeline and regulatory milestones for new drugs.

Today, Wockhardt’s turnaround story highlights how focused leadership, strategic realignment toward innovation, and commitment to breakthrough drug development can revive a company’s fortunes — shifting it from the verge of collapse toward the cusp of pharmaceutical relevance on a global stage.