Caution: For private circulation only.Please note that Money Times is for circulation among paid subscribers only. Any attempt to share your access to our website or forwarding your copy to a non-subscriber will disqualify your membership and we will be compelled to stop your supply and forfeit your subscription thereafter without any refund to you.

Shringar House of Mangalsutra Ltd.: Experienced promoters but steeply priced

Incorporated in 2009, Shringar House of Mangalsutra Ltd. (SHML) is a B2B manufacturer of mangalsutras made from gold, diamond, silver and other precious metals. The company supplies to leading retail brands such as Titan, Malabar, Joyalukkas, Reliance Retail and others.

SHML claims that it is not directly impacted by the recently imposed US tariffs since its business is largely domestic and caters to corporate retail customers in India. However, its operations could be indirectly affected if the exports of its corporate clients face challenges due to these tariffs.

The business is highly capital intensive. While revenue rose nearly 50% between March 2023 and March 2025, net working capital requirements almost doubled to Rs.270 crore. The company reported negative operating cash flows in the last two fiscals, mainly because advances must be paid upfront for raw materials such as gold and diamonds.

The promoters, who are highly experienced, will continue to hold about 75% of post-issue capital. Capacity utilisation remains at around 70%, possibly due to seasonality in demand. IPO proceeds may partly go towards capex, though specific details are yet to be announced. A recent spurt in margins and profitability before the IPO raises concerns over its sustainability, and future performance needs to be monitored.

The company has issued 1.5 lakh forfeited shares in 2011 at Rs.195 per share to the promoters and also allotted bonus shares in the ratio of 7:1 prior to the IPO. As a result, the average promoter holding cost is less than Rs.2 per share.

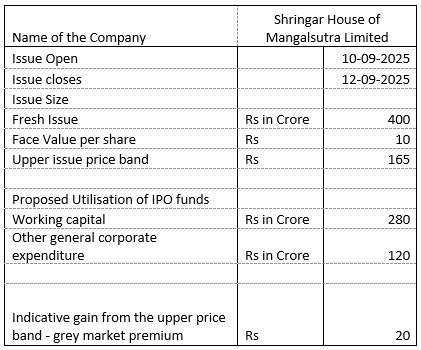

Grey market premium of about Rs.20 values SHML at a P/E multiple of 30x compared to 15–16x for listed peers like RBZ Jewellers and Utsav CZ. Sky Gold, another peer (not strictly comparable), trades at a P/E multiple of 32x.

Financials: (Rs. in crore)

| Particulars | Mar-25 | Mar-24 | Mar-23 |

| Tootal Income | 1430 | 1103 | 951 |

| Net Profit | 61 | 31 | 23 |

| Asset Turnover ratio | 3.79 | 4.16 | 4.49 |

Lower issue price would have made the IPO look attractive.

Disclaimer:

The writer is not a SEBI registered analyst. He and his friends and relatives may or may not participate in the IPO. Investors should consult their financial advisor before investing. Grey market premium is just an indicator and should not be relied upon.

Leave A Comment