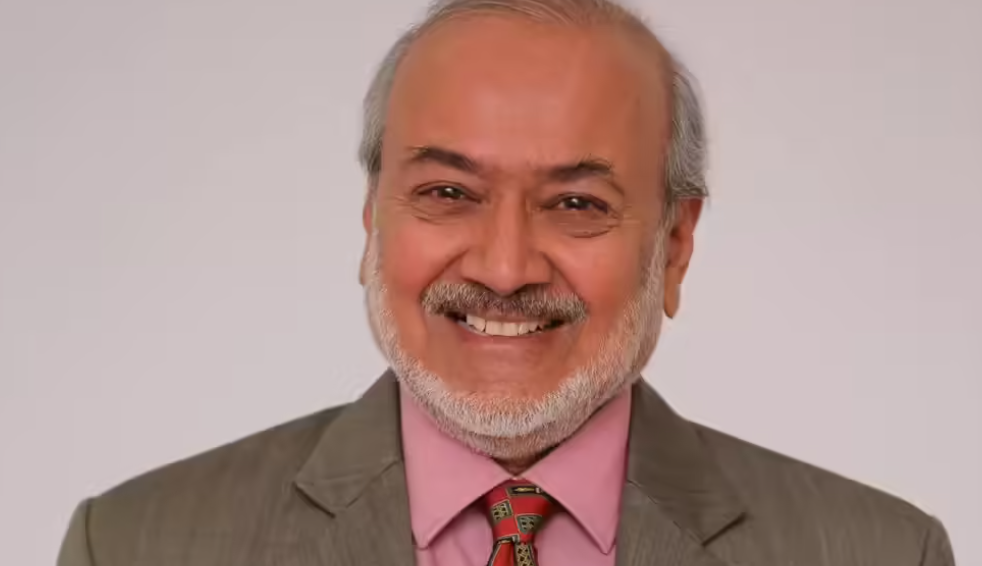

Wockhardt Ltd, once on the brink of collapse with heavy debt and troubled operations, has staged a remarkable turnaround under the leadership of Habil Khorakiwala, its founder and chairman, transforming from a debt-burdened pharmaceutical firm into a company with renewed strategic direction and potential global impact.