Caution: For private circulation only.Please note that Money Times is for circulation among paid subscribers only. Any attempt to share your access to our website or forwarding your copy to a non-subscriber will disqualify your membership and we will be compelled to stop your supply and forfeit your subscription thereafter without any refund to you.

By Nitin Negandhi

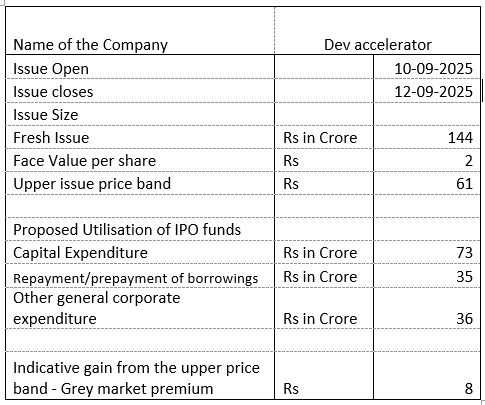

Dev Accelerator – Wafer thin net margin – low asset turnover ratio

Dev Accelerator Ltd., an Ahemdabad based eight year old company is engaged in providing flexible work spaces , developing and designing office spaces.

The company with high debt equity ratio of over 2 times plans to repay / prepay some of its borrowings. It has assets worth over Rs 500 crore with low asset cover ratio. The companies in this field have good EBIDTA margin but after accounting for huge depreciation and interest, very little is available @ the net level. In case of Dev , net margin stood very low @ around 1%.

Post issue promoter’s holding will come down from 50% to less than 37%. The company incurred losses in fiscals 2022 and 2023. The existing investors were rewarded bonus in the ratio of 900 shares for each share held in Sept 2024

Indiqube Spaces, a peer listed company is quoting below par. In case of Dev IPO, high debt equity ratio, low asset turnover ratio and wafer this margin – one wonders whether the IPO will provide any listing gains.

Financials: (Rs. in crore)

| Particulars | Mar-25 | Mar-24 | Mar-23 |

| Total Income | 179 | 110 | 71 |

| Net Profit | 1.7 | 0.5 | 23 |

| Asset Turnover ratio | 0.33 | 0.27 | 0.25 |

Disclaimer:

The writer is not a SEBI registered analyst. He and his friends and relatives may or may not participate in the IPO. Investors should consult their financial advisor before investing. Grey market premium is just an indicator and should not be relied upon.

Leave A Comment